Loan Quote Template - YLW - 220916

In today's fast-paced lending environment, loan quote templates play a crucial role in streamlining the process of acquiring funds for both borrowers and lenders. This comprehensive guide will provide you with a detailed understanding of loan quote templates, their importance, essential elements, and how to create and effectively utilize them. We will also address frequently asked questions to ensure you have a thorough understanding of the subject.

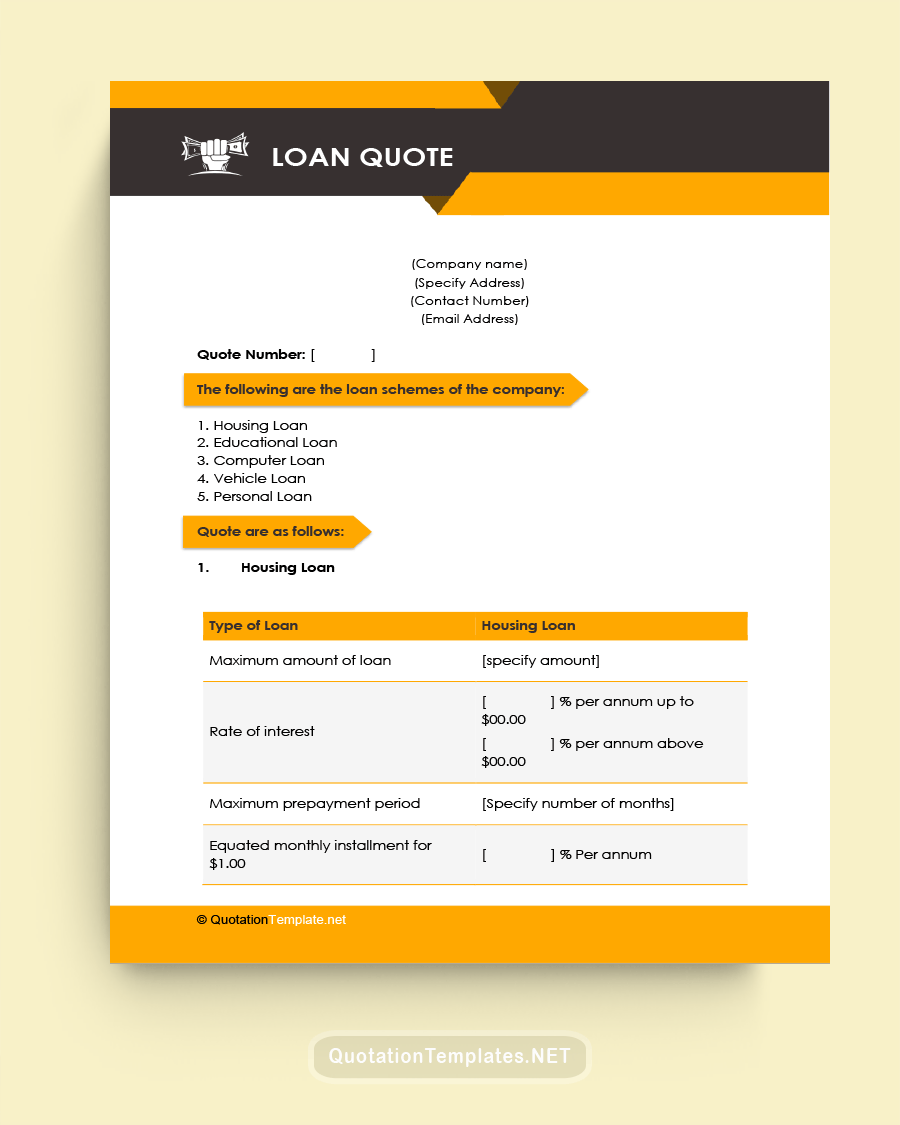

What is a Loan Quote Template?

A loan quote template is a standardized document used by financial institutions, lenders, and borrowers to communicate the terms and conditions of a loan proposal. It simplifies the process of comparing different loan offers and provides borrowers with the necessary information to make informed decisions. A well-designed loan quote template can save time, reduce errors, and increase transparency in the lending process.

Why is a Loan Quote Template Important?

- Clear Communication Loan quote templates are essential because they ensure clear and concise communication between lenders and borrowers. They present all pertinent information about a loan in a consistent format, making it easier for borrowers to compare offers and make informed decisions.

- Efficient Process Using a loan quote template streamlines the lending process by eliminating the need to create a new document each time a quote is requested. Lenders can quickly generate quotes, and borrowers can easily compare offers from different sources.

- Reduces Errors A standardized template minimizes the chances of errors and miscommunication. It ensures that all necessary information is included in the quote, reducing the likelihood of misunderstandings and disputes.

Essential Elements of a Loan Quote Template

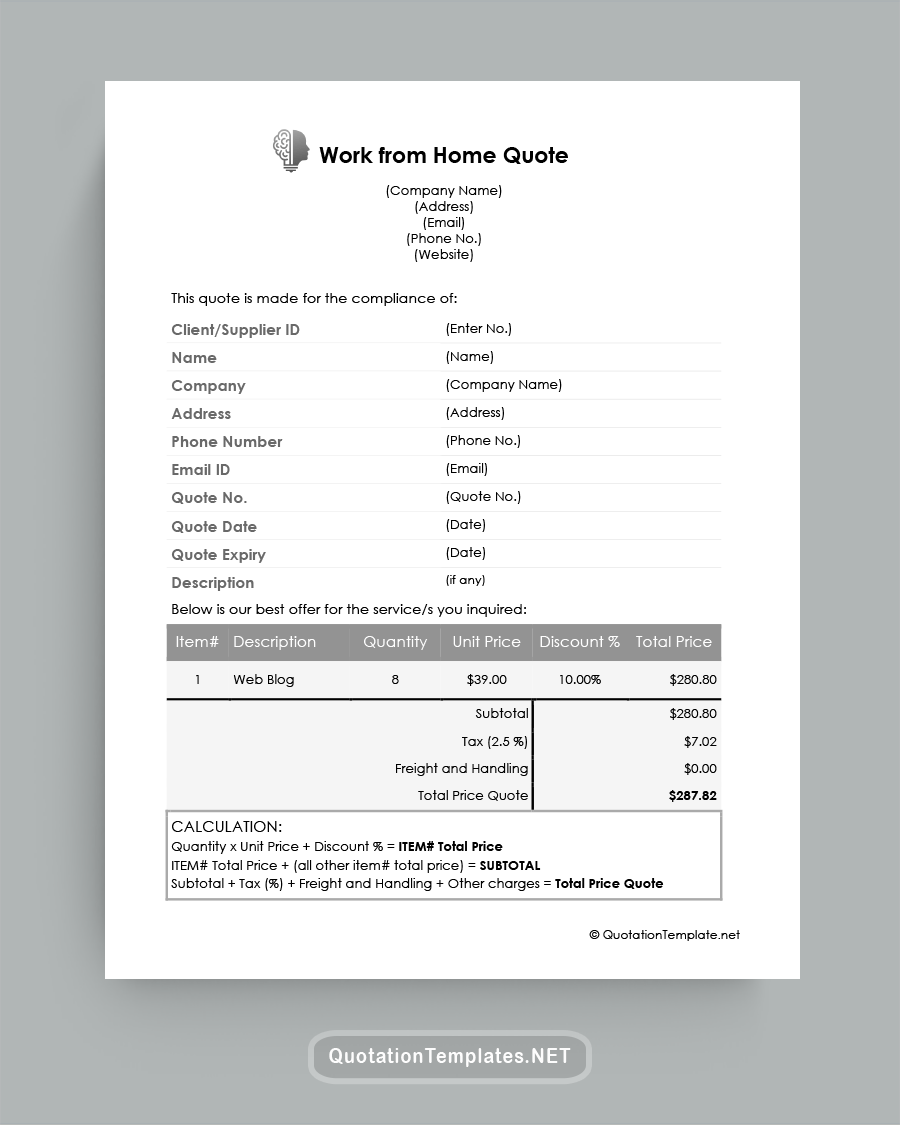

A loan quote template should include the following essential elements:

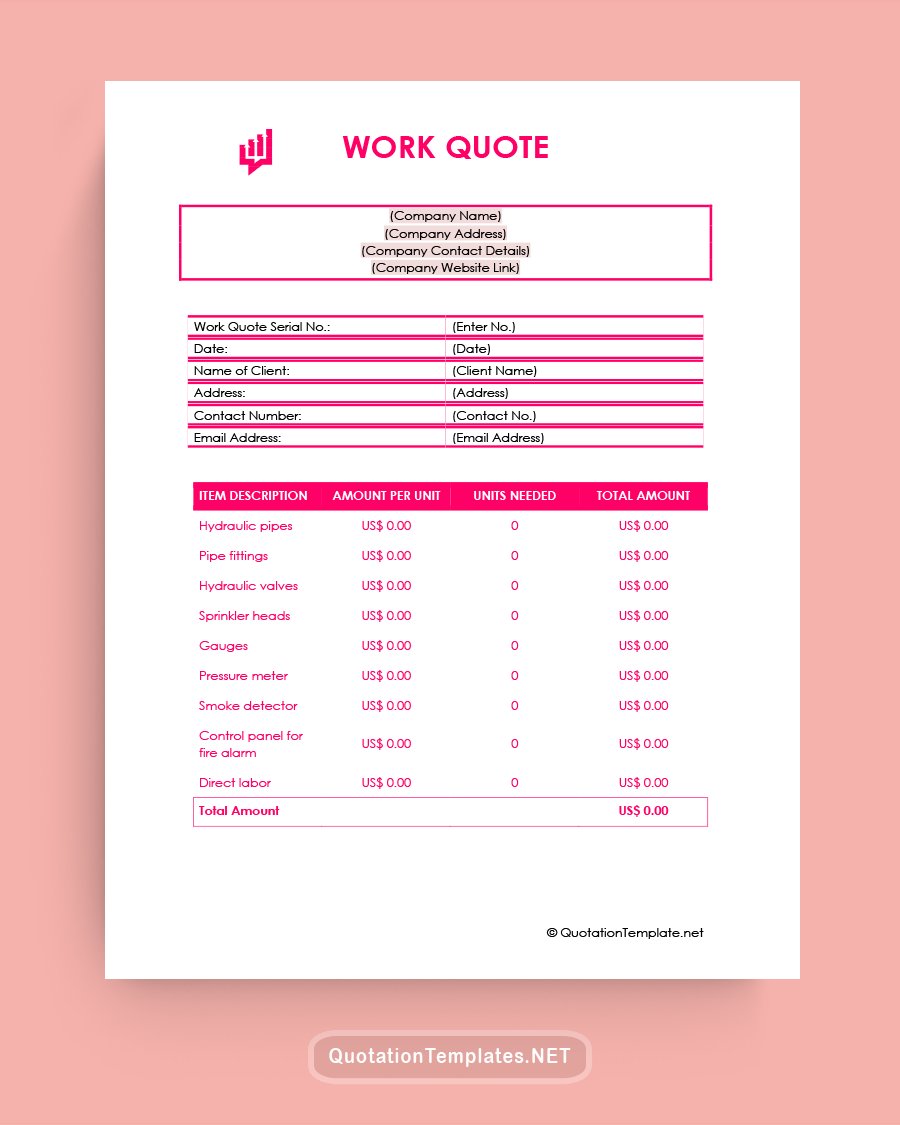

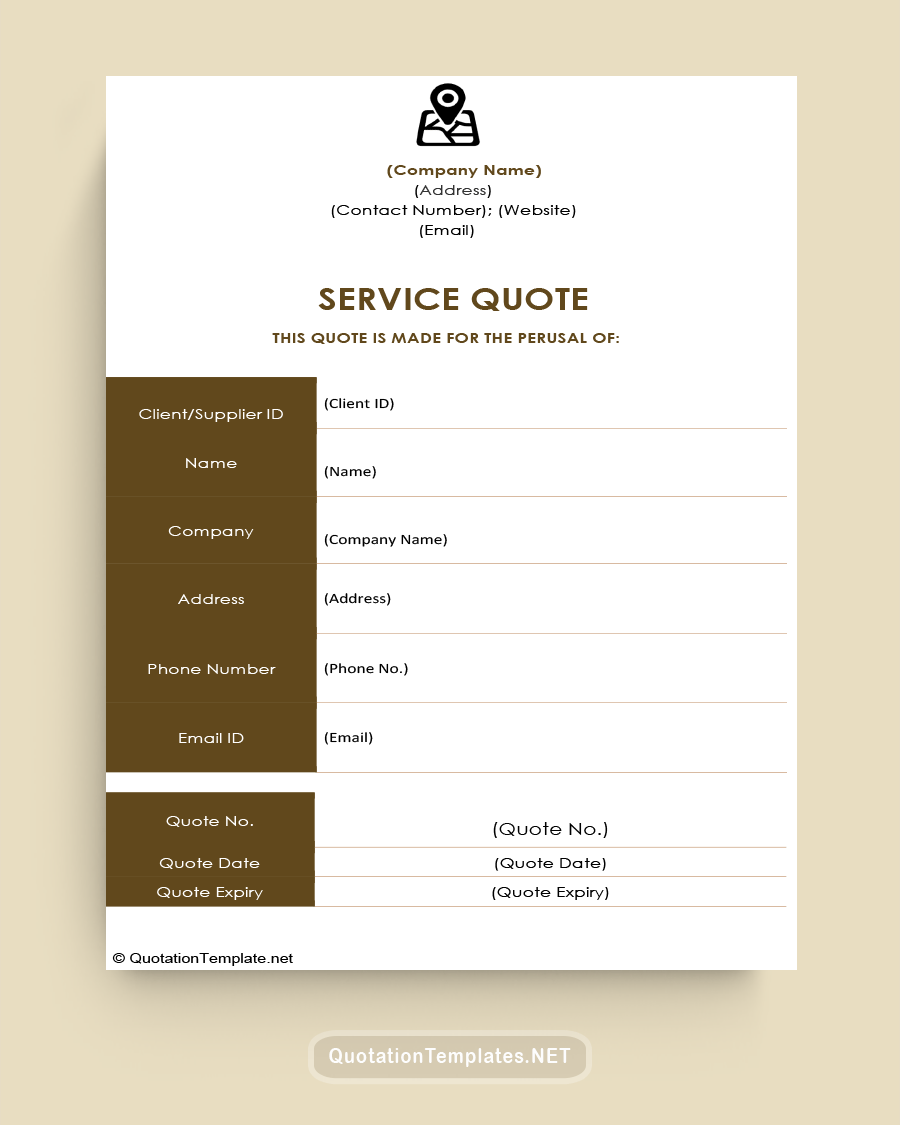

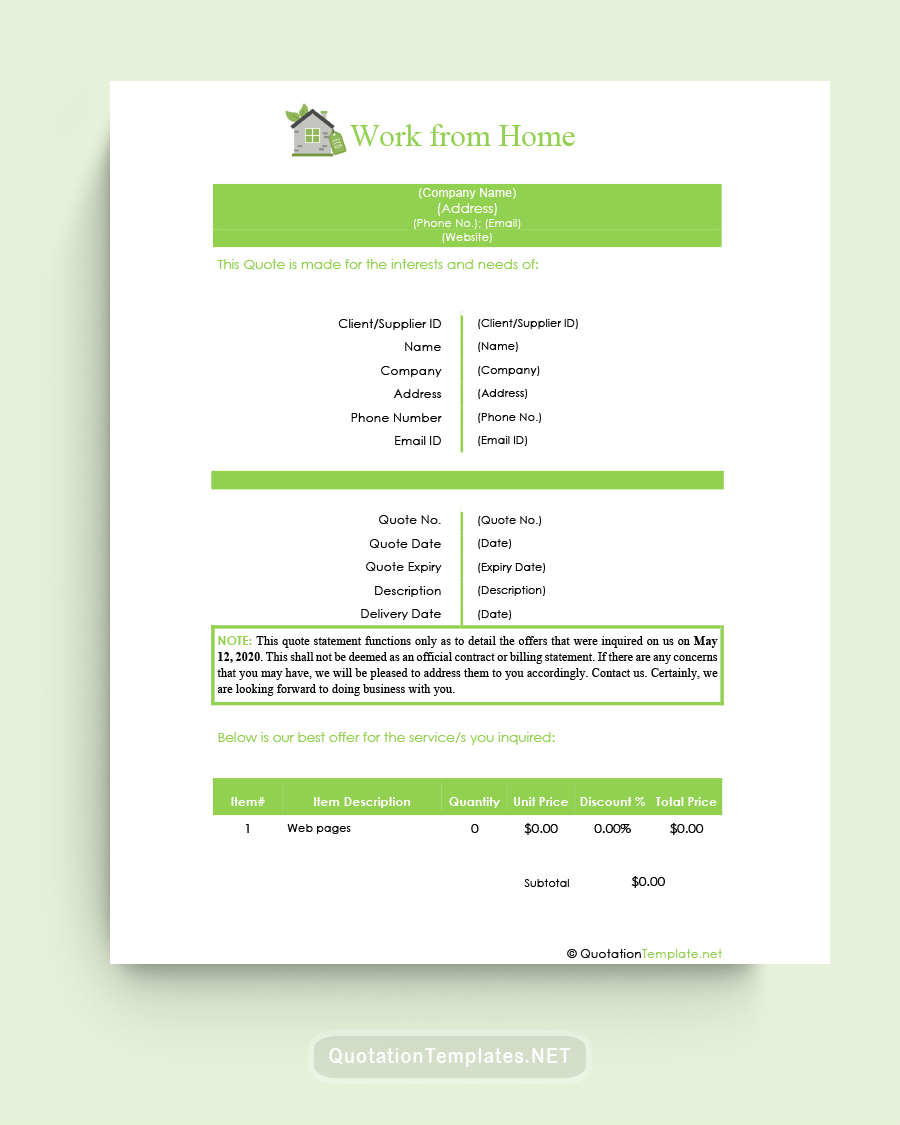

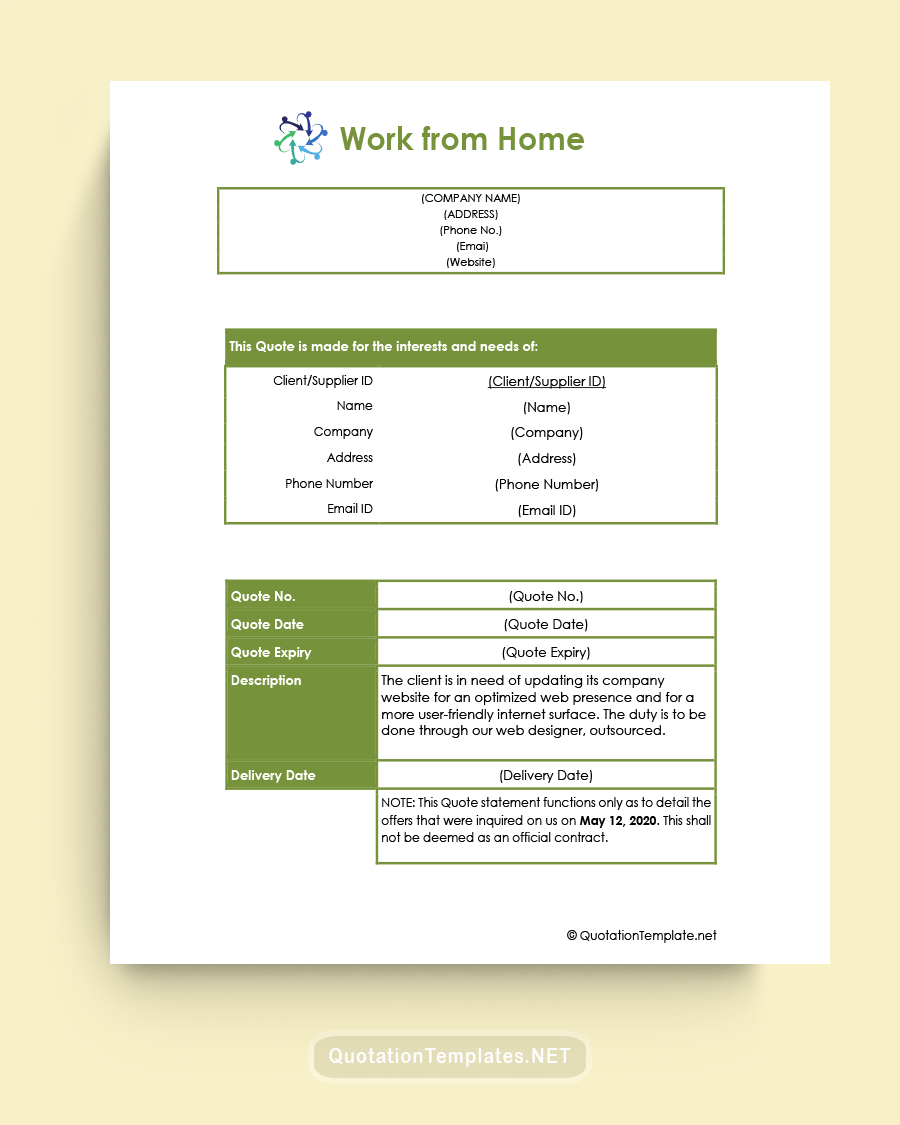

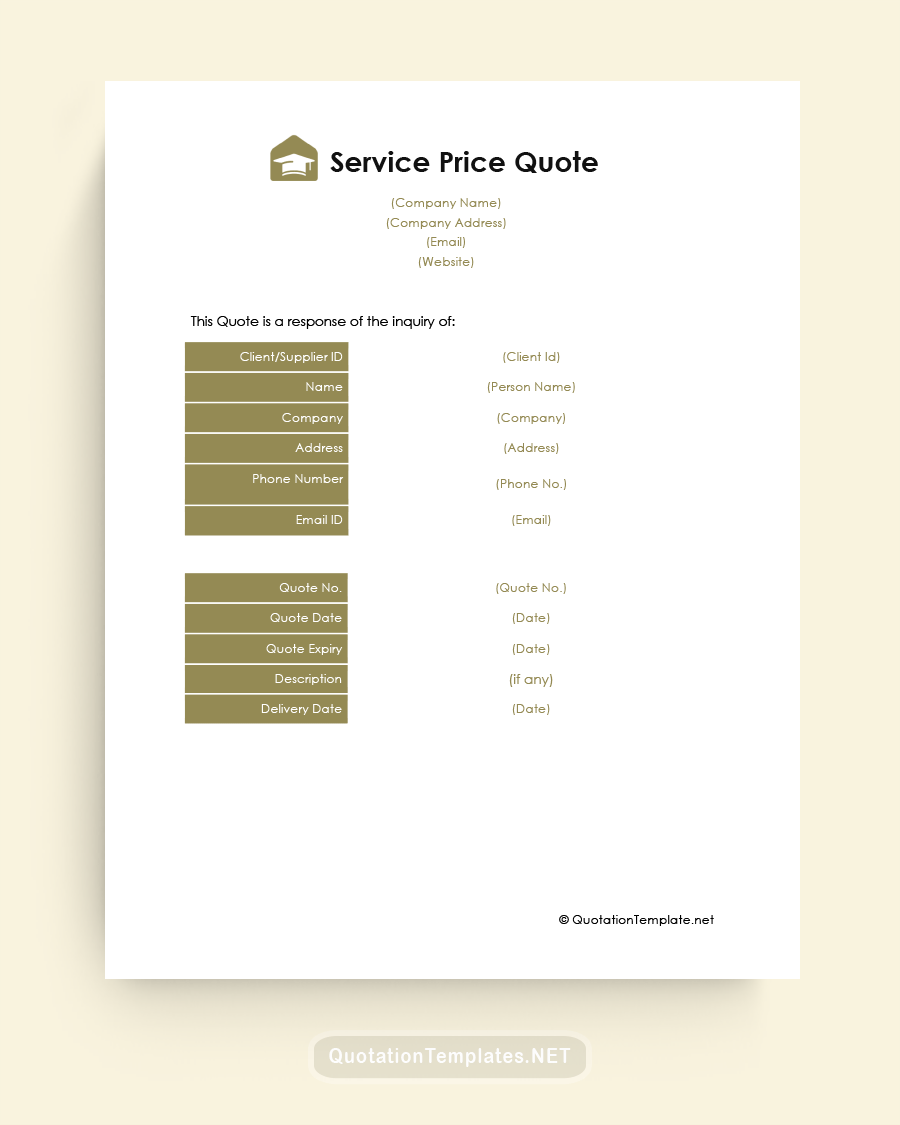

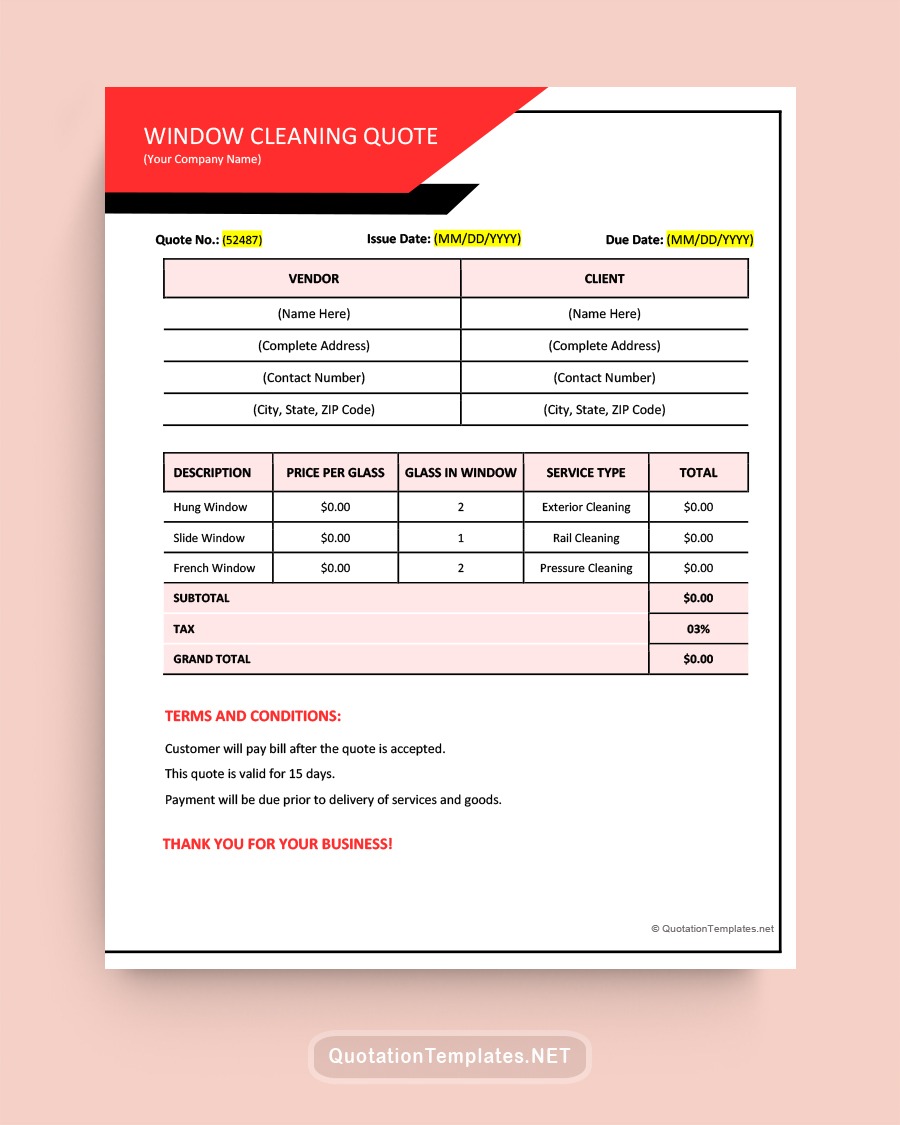

- Lender Information: Name, address, and contact information of the financial institution or lending company.

- Borrower Information: Name, address, and contact information of the prospective borrower.

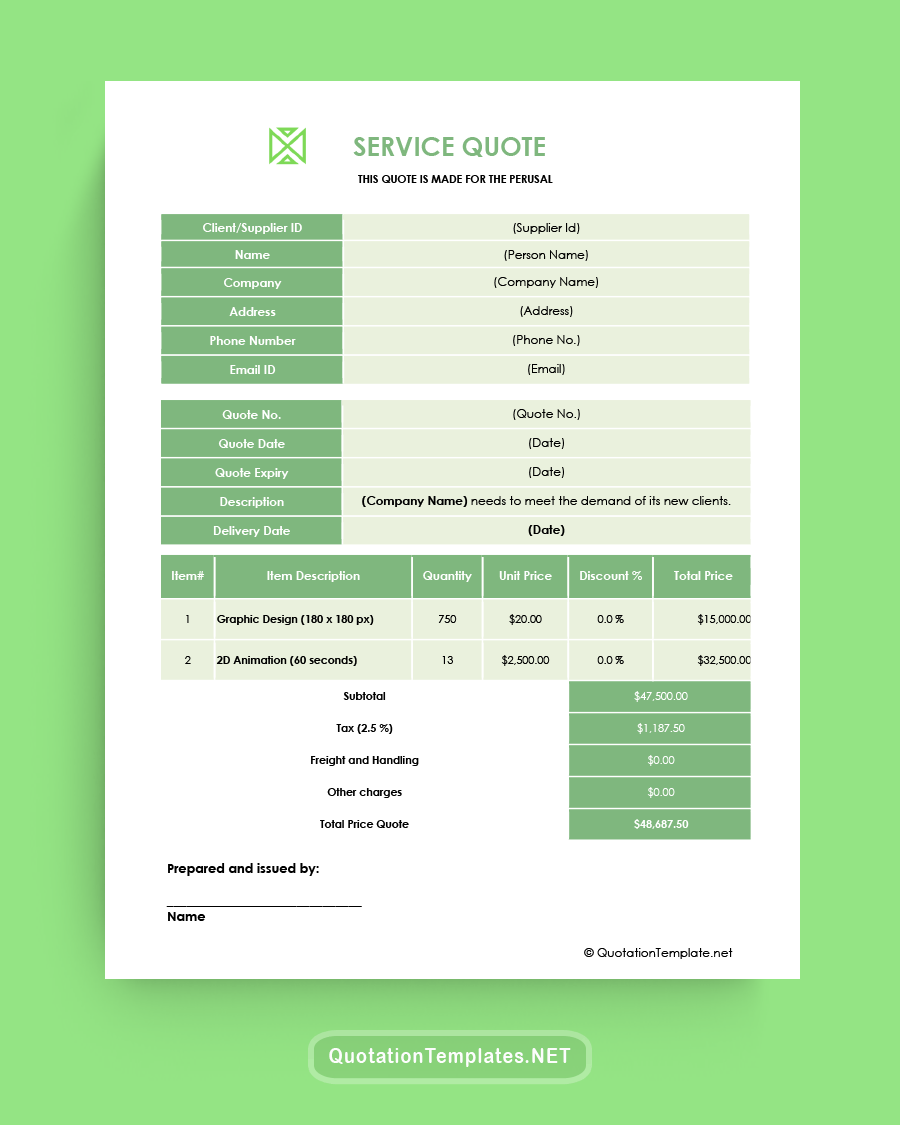

- Loan Amount: The total amount of the loan being proposed.

- Interest Rate: The annual percentage rate (APR) of the loan.

- Loan Term: The duration of the loan, typically expressed in months or years.

- Monthly Payment: The calculated monthly payment for the loan, including principal and interest.

- Fees and Charges: A list of any additional fees or charges associated with the loan, such as origination fees, prepayment penalties, or late fees.

- Collateral: If applicable, a description of the collateral that will secure the loan.

- Closing Costs: An estimation of the costs associated with closing the loan, such as appraisal fees, title insurance, and legal fees.

- Additional Terms and Conditions: Any other relevant information, such as prepayment options, grace periods, or restrictions.

How to Create a Loan Quote Template?

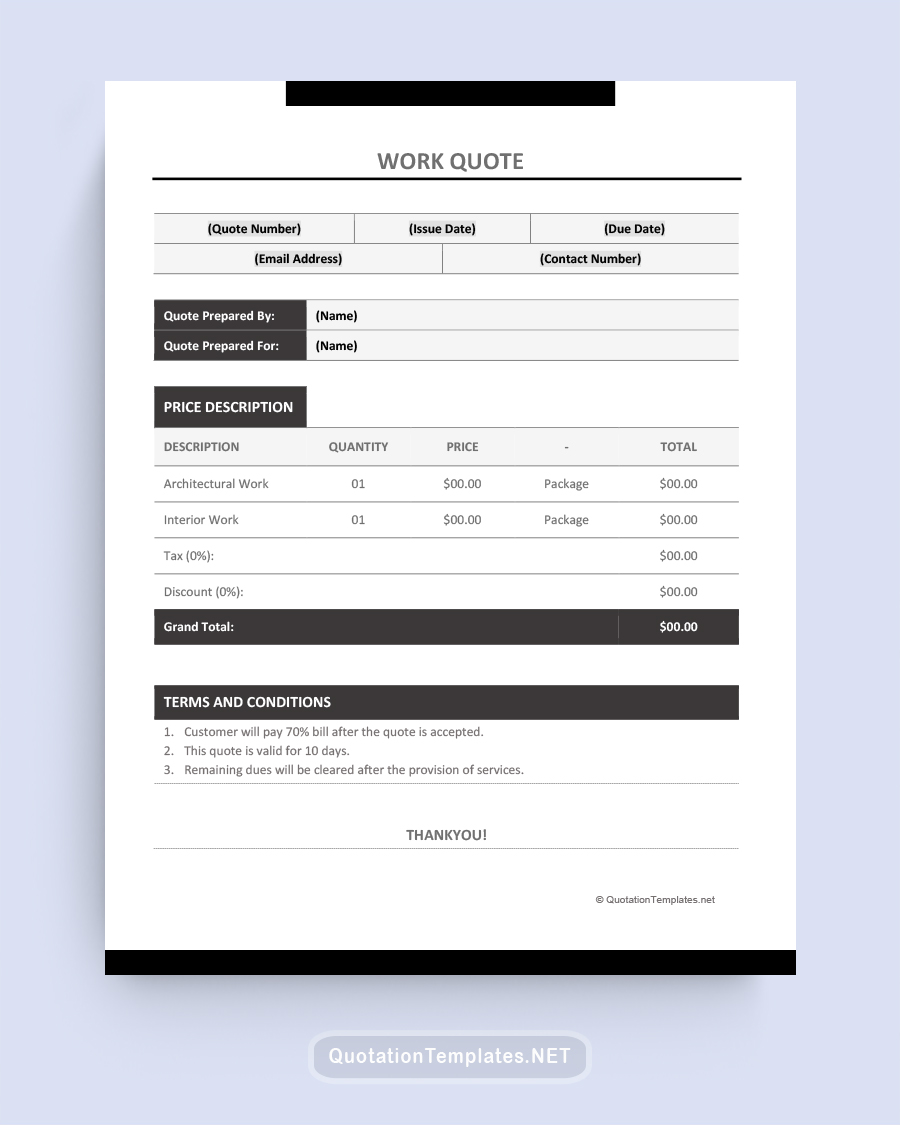

- Choose a format: Select a suitable format for your loan quote template, such as a Word document, Excel spreadsheet, or PDF.

- Design the layout: Create a clean, organized layout that is easy to read and understand. Use headings, bullet points, and tables to present information clearly.

- Include essential elements: Ensure that all the essential elements listed above are included in the template.

- Customize: Tailor the template to your specific industry or lending practices, if necessary.

- Review and refine: Proofread the template for errors and make any necessary adjustments. You may also want to have a colleague or industry expert review it for clarity and completeness.

Tips for Using a Printable Loan Quote Template

- Keep it updated: Regularly review and update your loan quote template to ensure it reflects current lending practices, regulations, and market conditions.

- Be consistent: Use the same template for all loan quotes to maintain consistency and ensure accurate comparisons for borrowers.

- Customize for specific loans: Although using a standardized template is beneficial, it's essential to tailor the information to the specific loan being quoted. This may include unique terms, conditions, or requirements.

- Be transparent: Clearly disclose all fees, charges, and terms associated with the loan to ensure borrowers have all the necessary information to make informed decisions.

- Provide clear instructions: Offer guidance on how to read and interpret the loan quote, as well as steps for borrowers to follow if they have questions or need clarification.

FAQs

How can I obtain a loan quote template?

You can find loan quote templates online or create your own using the guidelines provided in this article. Some financial institutions and lending software providers may also offer templates as part of their services.

Is there a standard format for loan quote templates?

While there is no one-size-fits-all format, most loan quote templates follow a similar structure, including essential elements such as lender information, borrower information, loan amount, interest rate, term, and fees.

Can I modify a loan quote template to fit my specific needs?

Yes, you can customize a loan quote template to meet the unique requirements of your industry, lending practices, or specific loans.

Are loan quote templates legally binding?

Loan quote templates are generally not legally binding. They serve as a preliminary step in the lending process and provide borrowers with an overview of the proposed loan terms. A legally binding loan agreement is typically drafted and signed once the borrower has accepted a loan offer.

Conclusion

Loan quote templates are an invaluable tool for lenders and borrowers, simplifying the lending process and promoting transparency. By understanding the importance of loan quote templates, incorporating their essential elements, and using them effectively, lenders can provide borrowers with clear, consistent information and help them make informed decisions about their financing options. Additionally, using a standardized template saves time, reduces errors, and fosters trust between all parties involved in the lending process.