Car Insurance Quote - 220703 - RED

Car insurance is a significant part of owning a vehicle, as it helps protect the vehicle owner from financial loss in case of accidents, theft, or damages. A car insurance quote is a fundamental aspect of this protection. This article aims to explain what a car insurance quote is, why it is crucial, and its key components. We will also guide you through the process of creating a car insurance quote and provide some practical tips.

What is a Car Insurance Quote?

A car insurance quote is an estimate provided by an insurance company that indicates the rate you might pay for coverage. The quote is based on the information you provide about yourself, your vehicle, and your driving history. The insurance company uses this information to assess the risk associated with insuring you and to calculate the potential cost of a policy. Remember, each insurance company has different ways of calculating risk and determining rates, leading to variations in quotes.

Why Is Car Insurance Quote Important?

Car insurance quotes are essential for several reasons:

- Budgeting: They allow you to anticipate how much you will need to spend on car insurance, aiding in financial planning.

- Comparison: Quotes provide a baseline for comparing different insurance providers. You can compare rates and coverage to find the best value for your needs.

- Risk Assessment: The quote helps you understand how insurance companies perceive your level of risk. A higher quote might imply that you are considered a high-risk driver.

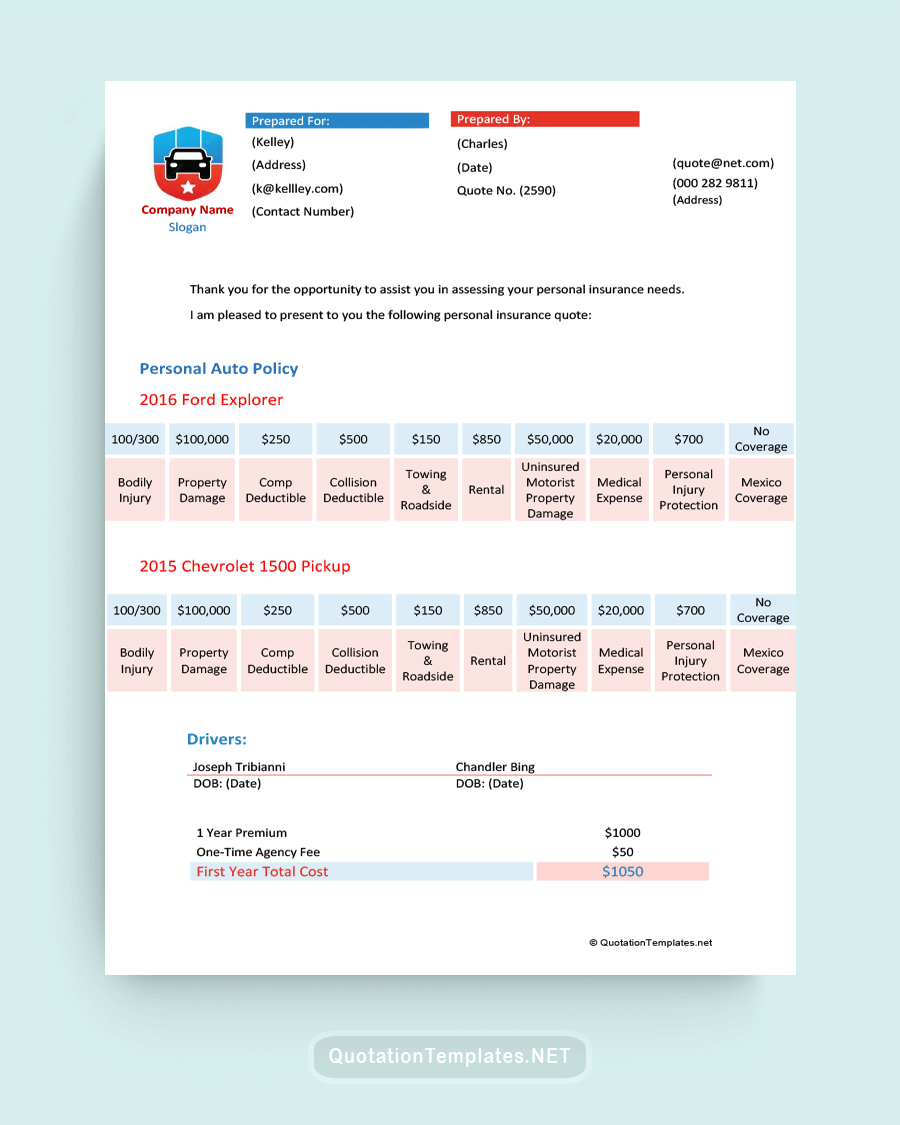

Essential Elements of a Car Insurance Quote

Several key elements are factored into a car insurance quote:

- Personal Information: This includes your age, gender, marital status, and residential address.

- Driving Record: Your driving history significantly impacts your quote. Incidents like accidents or violations can increase your rates.

- Vehicle Information: The make, model, year, and safety features of your car play a part in determining your quote.

- Coverage Details: The types of coverage you choose, such as liability, comprehensive, collision, and the limits for each, affect the quote.

- Deductible: The amount you choose to pay out-of-pocket in an accident can also alter the quote.

How to Create a Car Insurance Quote?

Most insurance companies offer online tools to create car insurance quotes:

- Visit the Insurer's Website: Go to the insurance company's website and look for the "get a quote" or similar option.

- Provide Personal Information: Fill in the necessary details about yourself and your driving history.

- Provide Vehicle Information: Enter details about your vehicle, including its make, model, year, and safety features.

- Choose Your Coverage: Select the types of coverage and limits you want.

- Receive Your Quote: The insurance company will calculate your quote based on the information provided.

Tips for Using a Printable Car Insurance Quote

A printable car insurance quote can be a handy tool for comparison and negotiation. Here are a few tips:

- Compare Multiple Quotes: Gather and print quotes from several insurance companies for comparison.

- Check the Details: Make sure all personal and vehicle information is accurate in the quote.

- Negotiate: Use printed quotes as a negotiation tool when talking with insurance agents.

Frequently Asked Questions

Does getting a quote affect my credit score?

No, obtaining a car insurance quote is a soft inquiry and does not affect your credit score.

How often should I get a new quote?

It's good practice to get new quotes at least once a year or whenever there's a significant change in your life, such as buying a new car or moving.

Why are my friend's rates lower than mine?

Car insurance rates depend on many factors, including driving history, vehicle type, location, and age. Different people can have different rates even with the same insurance company.

Additional Factors Influencing Car Insurance Quotes

There are several additional factors that can influence the cost of your car insurance quote:

- Credit Score: In many states, insurers use credit scores to predict the likelihood of a claim. A lower score might lead to a higher quote.

- Driving Experience: New drivers or those with less experience typically have higher insurance rates.

- Claims History: If you've made several claims in the past, insurers may consider you a high-risk driver and increase your rates.

Conclusion

Understanding car insurance quotes is crucial for every driver. Quotes not only provide an estimate of your potential insurance costs, they also offer insights into how insurers assess your risk level. By understanding the key elements of a car insurance quote and the process of obtaining one, you can make more informed decisions about your coverage. Keep in mind that it's beneficial to compare quotes from different insurers and negotiate to get the best deal.