Car Insurance Quote - 220701- BLU

Purchasing a car is a significant investment that deserves protection. While it is an exciting endeavor, owning a vehicle also comes with considerable responsibilities, among them obtaining the right car insurance. One of the crucial steps in this process is getting a car insurance quote.

What is a Car Insurance Quote?

A car insurance quote is an estimate provided by an insurance company, detailing how much you could potentially pay for your car insurance. This quote is based on the information you provide about yourself, your vehicle, and your driving history. Insurance quotes can vary significantly from company to company, so it's wise to get several quotes before settling on a policy.

Why Is a Car Insurance Quote Important?

Getting a car insurance quote is essential for a few key reasons:

- Financial Planning: A car insurance quote gives you an idea of your potential insurance costs, helping you budget appropriately.

- Comparison: Quotes allow you to compare different insurers' prices and coverage options, helping you find the best fit for your needs.

- Risk Assessment: Insurance quotes can also give you an insight into how insurers view your risk level as a driver.

Essential Elements of a Car Insurance Quote

A car insurance quote typically includes the following elements:

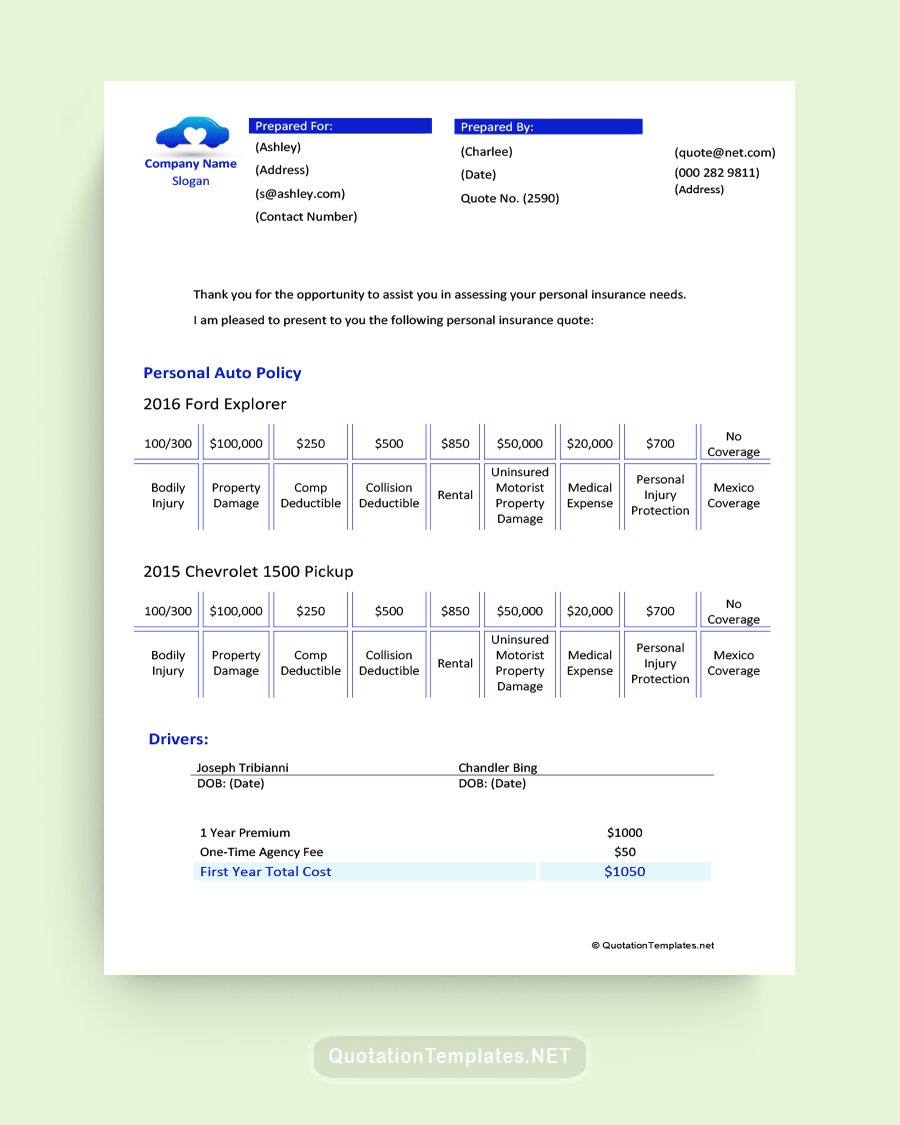

- Personal Information: Details such as your age, gender, marital status, and address.

- Vehicle Information: The make, model, age, and safety features of your car.

- Driving History: Your driving record, including any accidents or violations.

- Coverage Details: The types of coverage you want, such as liability, collision, comprehensive, and uninsured/underinsured motorist protection.

- Quote Price: The total cost you will be expected to pay for the selected coverage, often shown as an annual or six-month price.

How to Create a Car Insurance Quote

Obtaining a car insurance quote is a relatively straightforward process:

- Gather Your Information: Compile all the necessary personal, vehicle, and driving history information.

- Choose Coverage: Decide on the types of coverage you need.

- Contact Insurers: Reach out to multiple insurance companies or use an online comparison tool to get quotes.

- Review Quotes: Analyze the received quotes, focusing on both price and coverage.

- Choose a Policy: Based on your analysis, choose the policy that best suits your needs.

Tips for Using a Printable Car Insurance Quote

- Keep a Record: Having a printed quote can serve as a record of the price you were initially offered.

- Compare: Use printed quotes to make side-by-side comparisons between different companies.

- Negotiate: Use your quotes as a negotiation tool when speaking with insurance agents.

- Verify Details: Ensure all details on the printed quote are correct before finalizing a policy.

FAQs

Here are some commonly asked questions about car insurance quotes:

Does getting a car insurance quote affect my credit score?

No, obtaining car insurance quotes does not impact your credit score.

Why are my quotes from different companies so varied?

Each insurance company uses its own formula to calculate risk and determine premiums, resulting in varying quotes.

Conclusion

Car insurance quotes are an essential tool in finding the best insurance coverage for your needs. They provide a roadmap to understanding how much you're likely to pay and the coverage you can expect. With the tips and information outlined in this guide, you are well-equipped to navigate the insurance quote process confidently.