Home Insurance Quote - 220703 - RED

In today's world, where unforeseen circumstances can lead to substantial financial burdens, having home insurance offers invaluable peace of mind. To understand the potential costs and benefits, homeowners first need to receive a home insurance quote.

What is a Home Insurance Quote?

A home insurance quote is an estimate provided by an insurance company that details the cost of insuring your home. It takes into account a variety of factors including the location, size, and age of the home, as well as other risk factors like fire protection and security systems. This quote gives homeowners a sense of the insurance premium they can expect to pay for a specific level of coverage.

Why is a Home Insurance Quote Important?

A home insurance quote plays a crucial role for homeowners for several reasons:

- Financial Planning: It gives an idea of the insurance cost, which helps in budgeting and financial planning.

- Comparing Options: Quotes from different providers allow homeowners to compare and choose the best policy for their needs.

- Risk Evaluation: It reflects the insurer's assessment of the risk involved in insuring the home, highlighting potential areas for improvement.

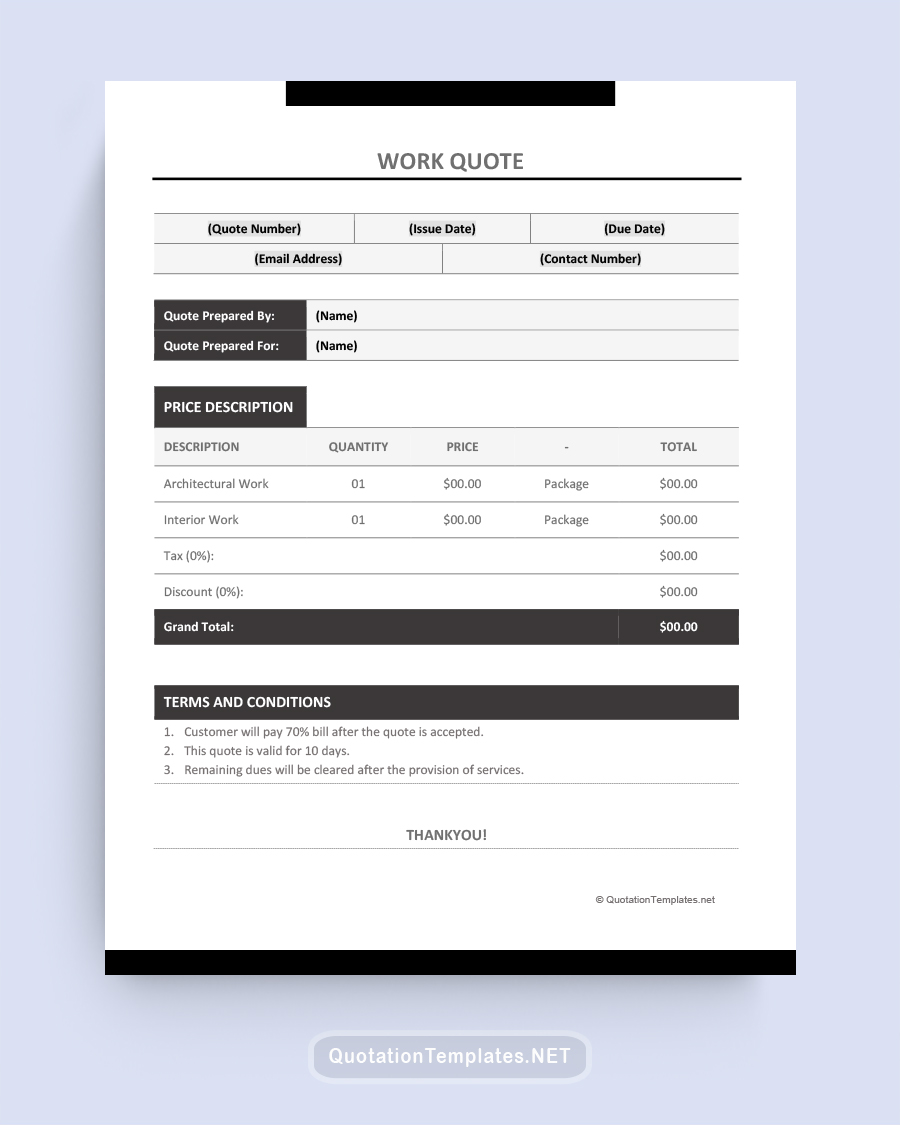

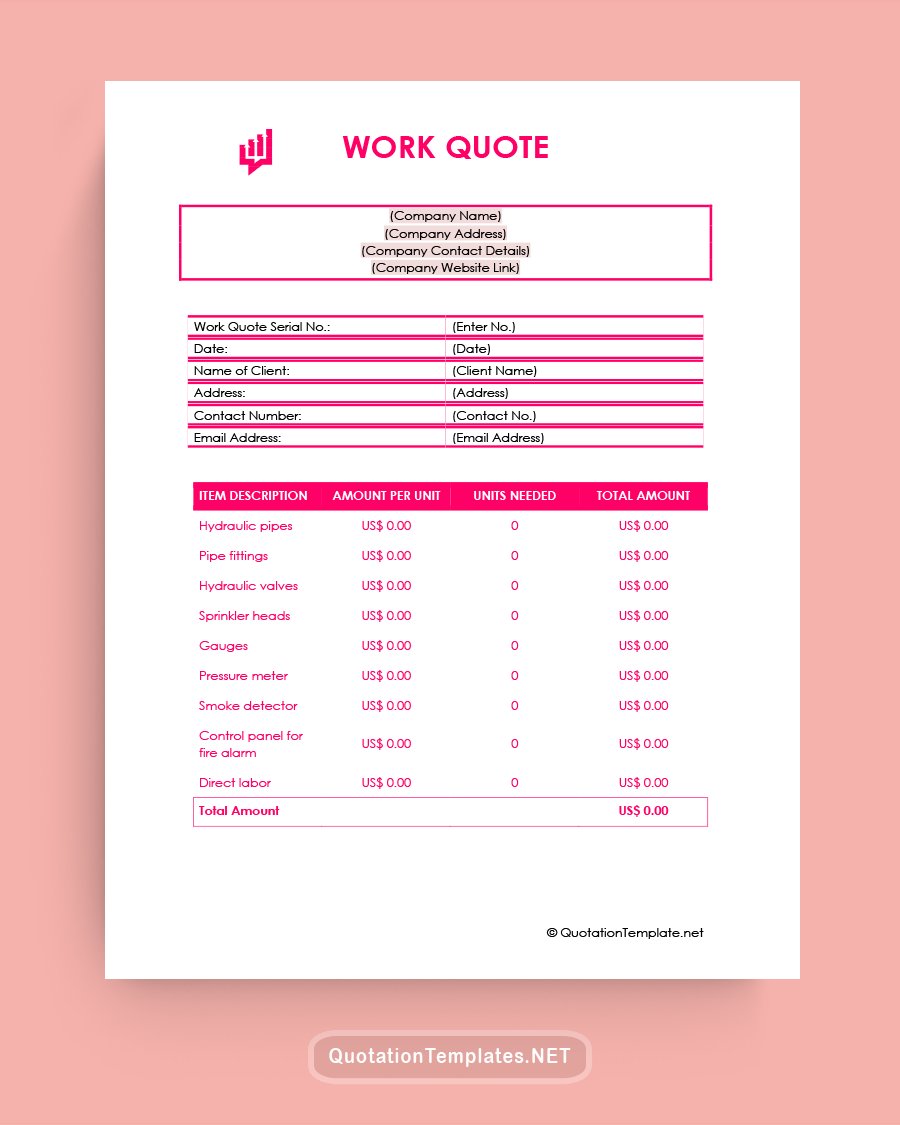

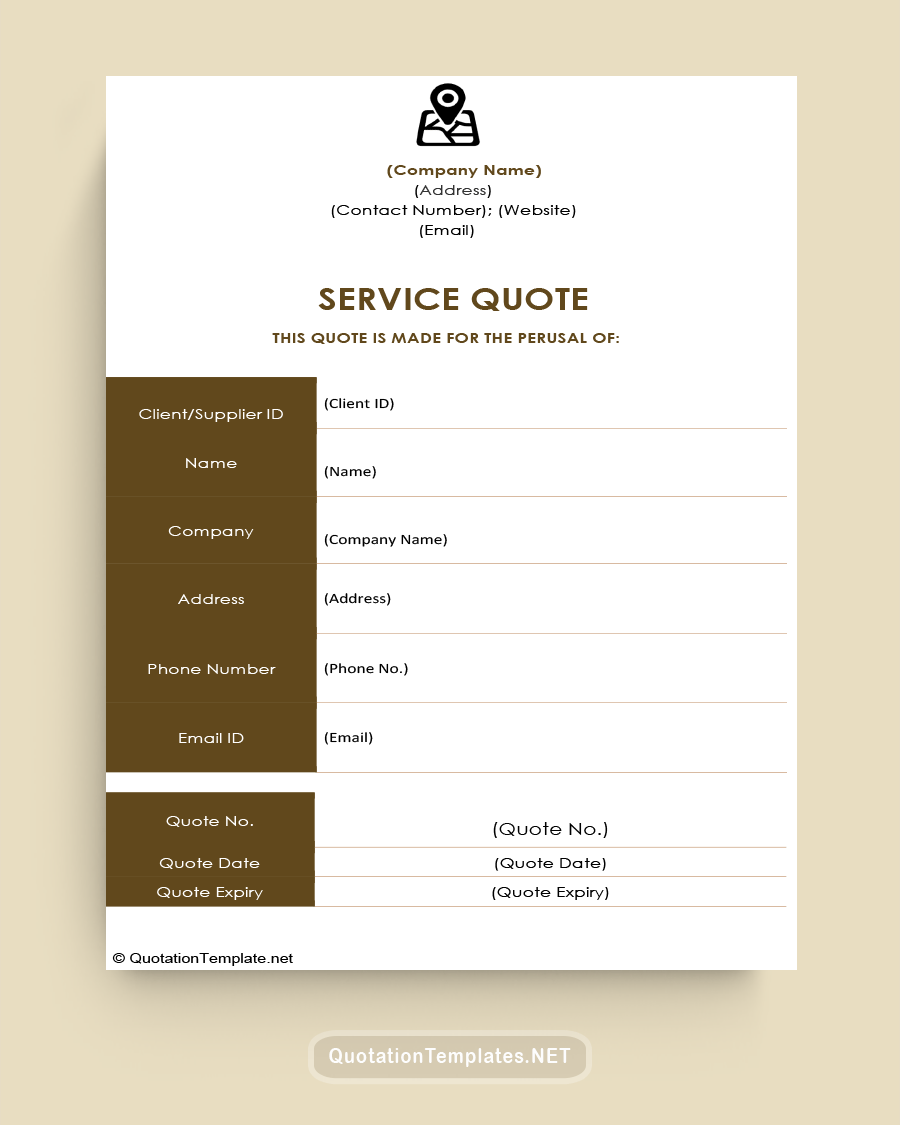

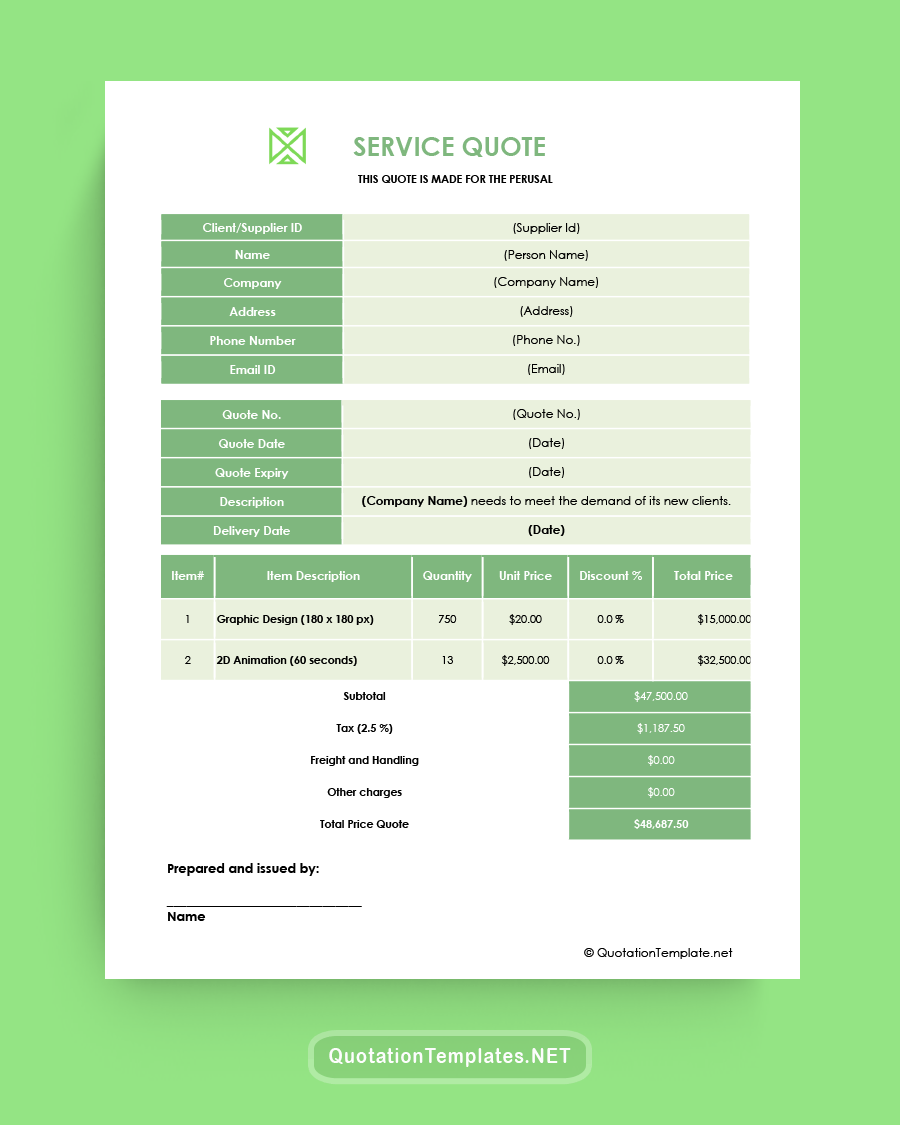

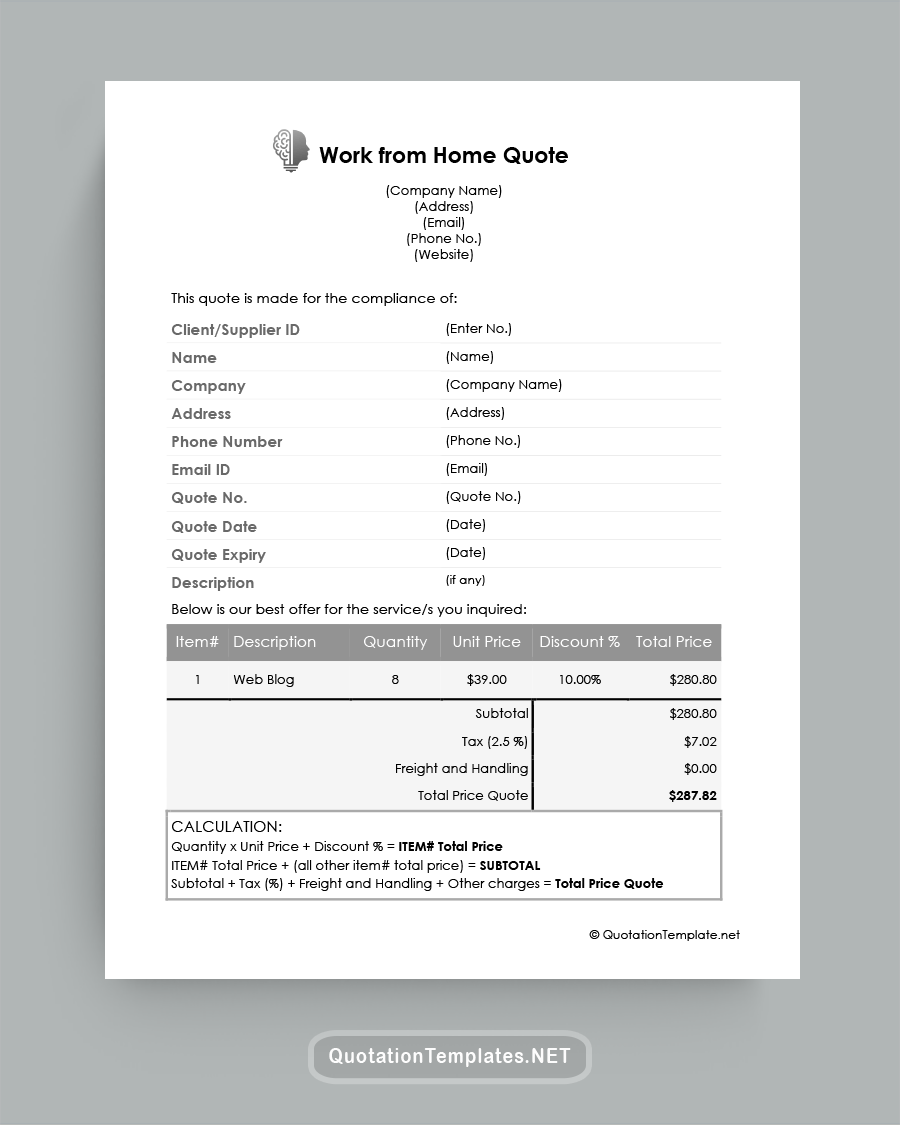

Essential Elements of a Home Insurance Quote

A comprehensive home insurance quote should contain several key components:

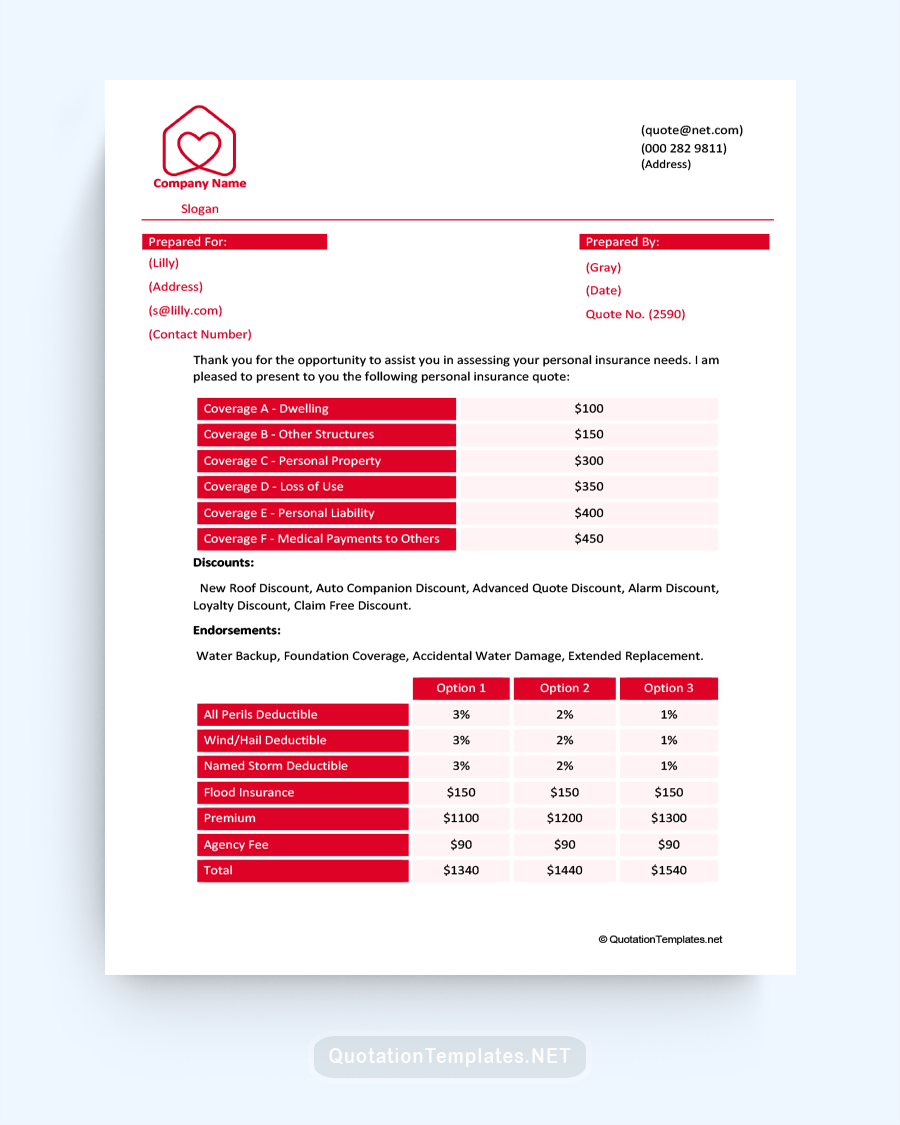

- Personal Information: This includes the homeowner's name, contact information, and any relevant personal history.

- Home Details: Information about the home such as its location, size, type, and age.

- Coverage Details: The different types of coverage included in the policy, along with their respective limits.

- Premium: The cost that the homeowner is expected to pay for the policy, usually expressed as an annual or monthly amount.

- Deductible: The amount the homeowner will have to pay out of pocket before the insurance coverage kicks in.

- Discounts: Any applicable discounts based on specific criteria or features.

How to Create a Home Insurance Quote

While insurance quotes are typically generated by insurers, it helps to understand the process:

- Gather Home Details: Collect all necessary details about your home, such as its age, size, type, location, and any safety features.

- Identify Coverage Needs: Determine the types and amounts of coverage you need, such as dwelling coverage, personal property coverage, and liability coverage.

- Contact Insurance Providers: Reach out to different insurance providers and provide them with your details and coverage needs.

- Review Quotes: Once you receive the quotes, review them thoroughly, comparing the coverage options, deductibles, premiums, and discounts.

Tips for Using a Printable Home Insurance Quote

- Keep Personal Information Secure: Ensure any document with personal information is kept secure to protect against identity theft.

- Review Quotes Thoroughly: Make sure you understand all elements of a quote before making a decision.

- Don't Focus Solely on Price: While the premium is important, also consider factors like coverage limits, customer service, and the insurer's reputation.

- Consider an Insurance Broker or Agent: They can help you navigate the complex world of insurance and find the best quote for your needs.

Frequently Asked Questions

Can I get a home insurance quote without personal information?

No, insurers require personal information to provide an accurate quote. This might include your name, contact information, and details about your home.

How often should I get a new home insurance quote?

It's recommended to get a new quote every few years or whenever there's a significant change to your home or personal situation.

Leveraging Home Insurance Quotes for Optimum Protection

Understanding and efficiently using home insurance quotes can lead to better protection for your home. Not only do these quotes provide insights into potential costs and coverages, they can also reveal areas in which you might bolster home security to lower your risk profile and thus, your premiums.

Conclusion

A home insurance quote is a vital first step towards safeguarding your home from potential hazards. By understanding the contents of a quote and how to utilize it, homeowners can make informed decisions about their home insurance. While the process might seem complex, with careful consideration and comparison, finding a quote that suits your needs and budget can be a straightforward endeavor.