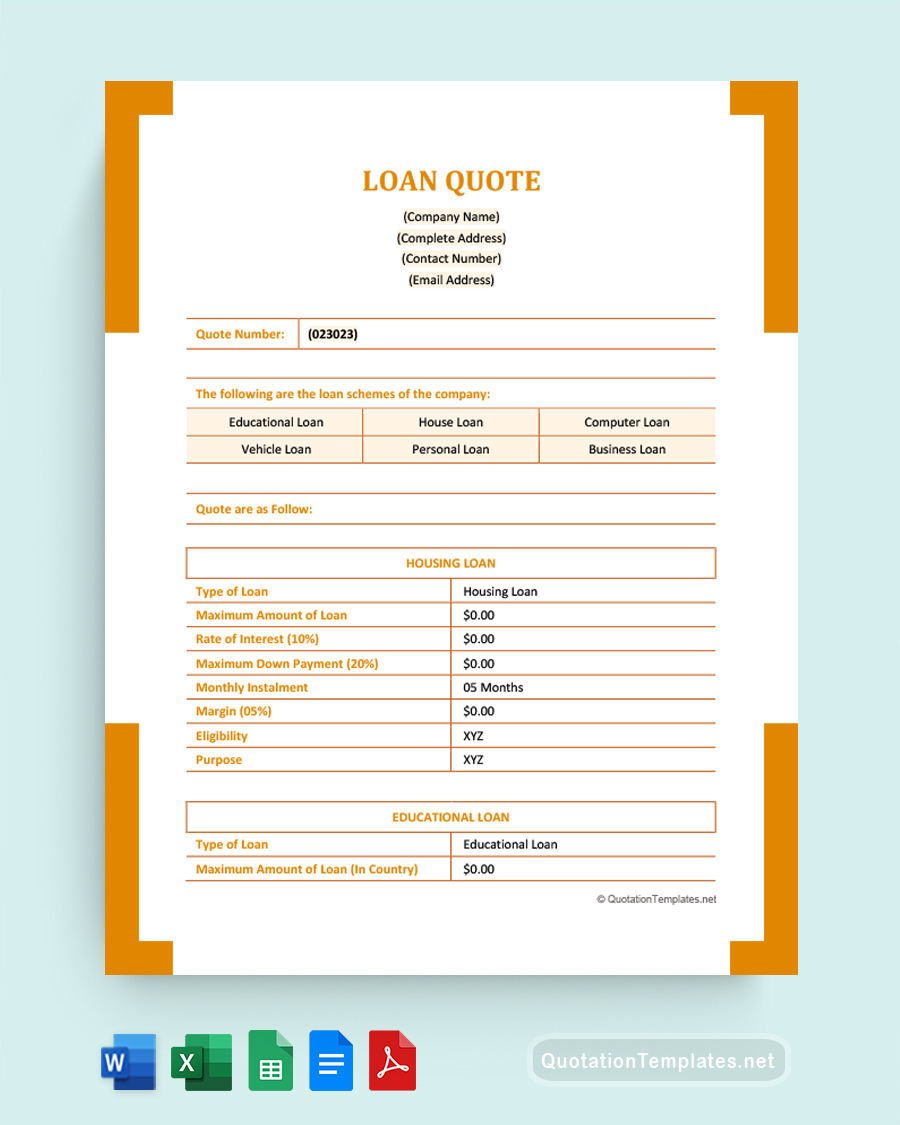

Loan Quote Template - ORG

A Loan Quote Template is a critical tool in the financial landscape, simplifying the loan process for both lenders and borrowers. This standardized document provides a clear breakdown of loan terms, enabling informed decision-making.

What is a Loan Quote Template?

A Loan Quote Template is a standardized document used by financial institutions or lenders to present potential loan terms to a borrower. It outlines critical details such as the loan amount, interest rate, repayment schedule, and any associated fees. This document serves as a formal statement of the loan terms, facilitating clear communication between the lender and borrower.

Why is a Loan Quote Template Important?

A Loan Quote Template brings numerous benefits to the loan process:

- Clarity and Transparency: The template ensures all necessary details are documented, reducing potential misunderstandings and disputes.

- Efficiency: It saves time by standardizing the process of providing loan quotes.

- Comparison: With all lenders providing information in a similar format, it becomes easier for the borrower to compare and make informed decisions.

- Professionalism: A formal template underscores the professionalism of your financial institution and fosters trust among potential borrowers.

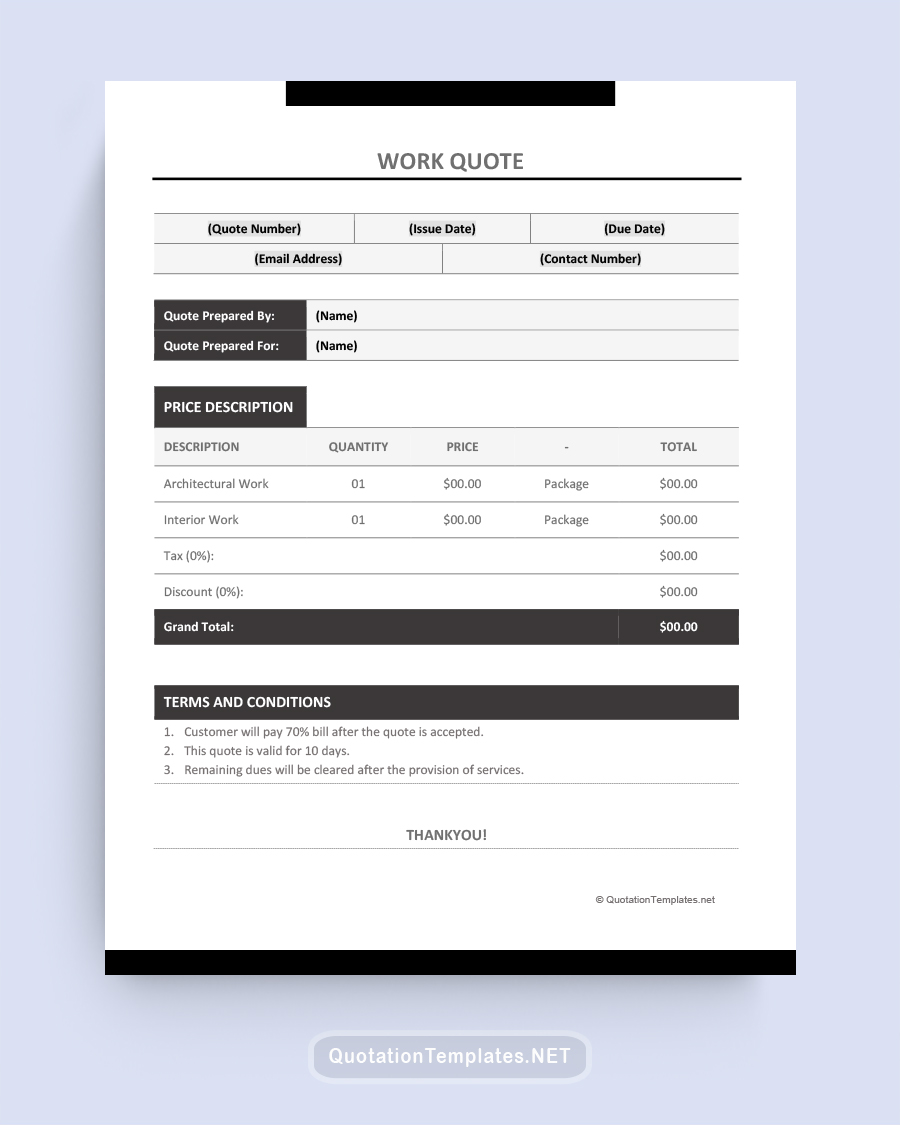

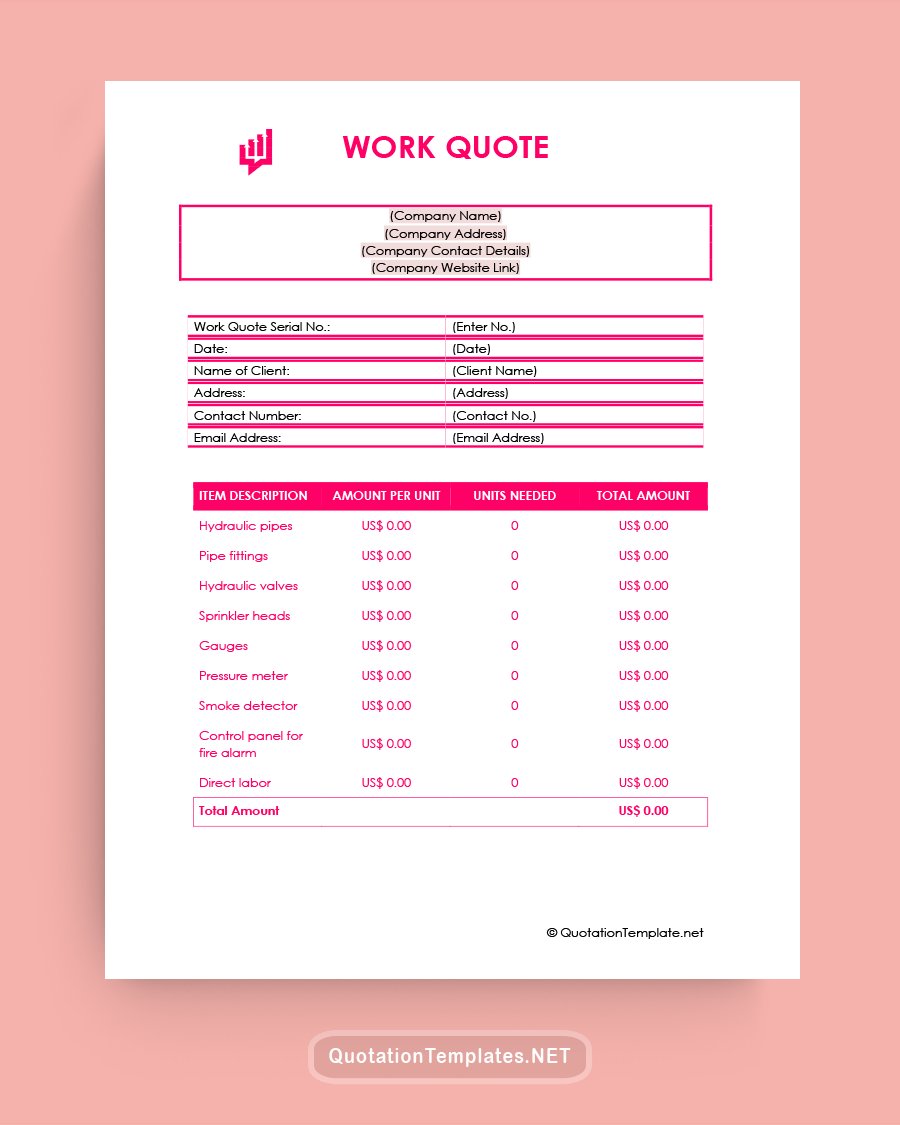

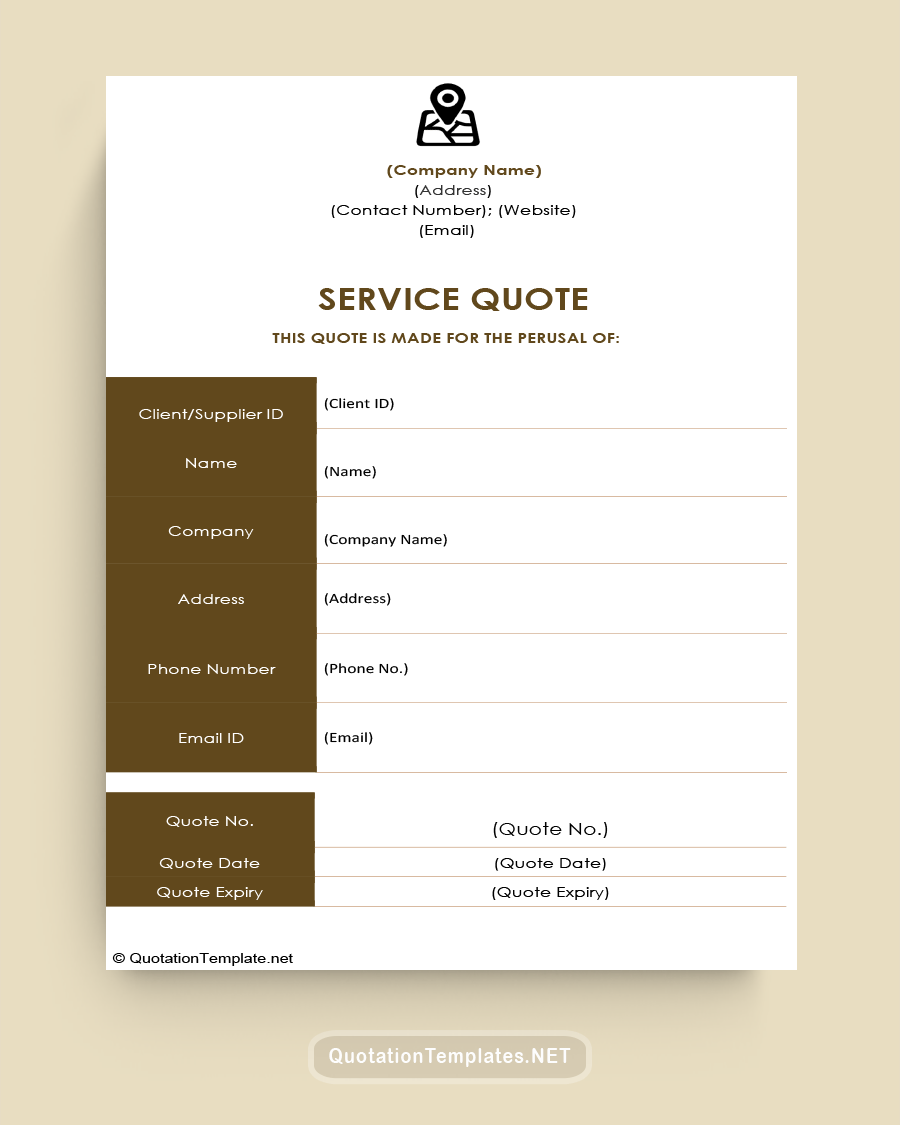

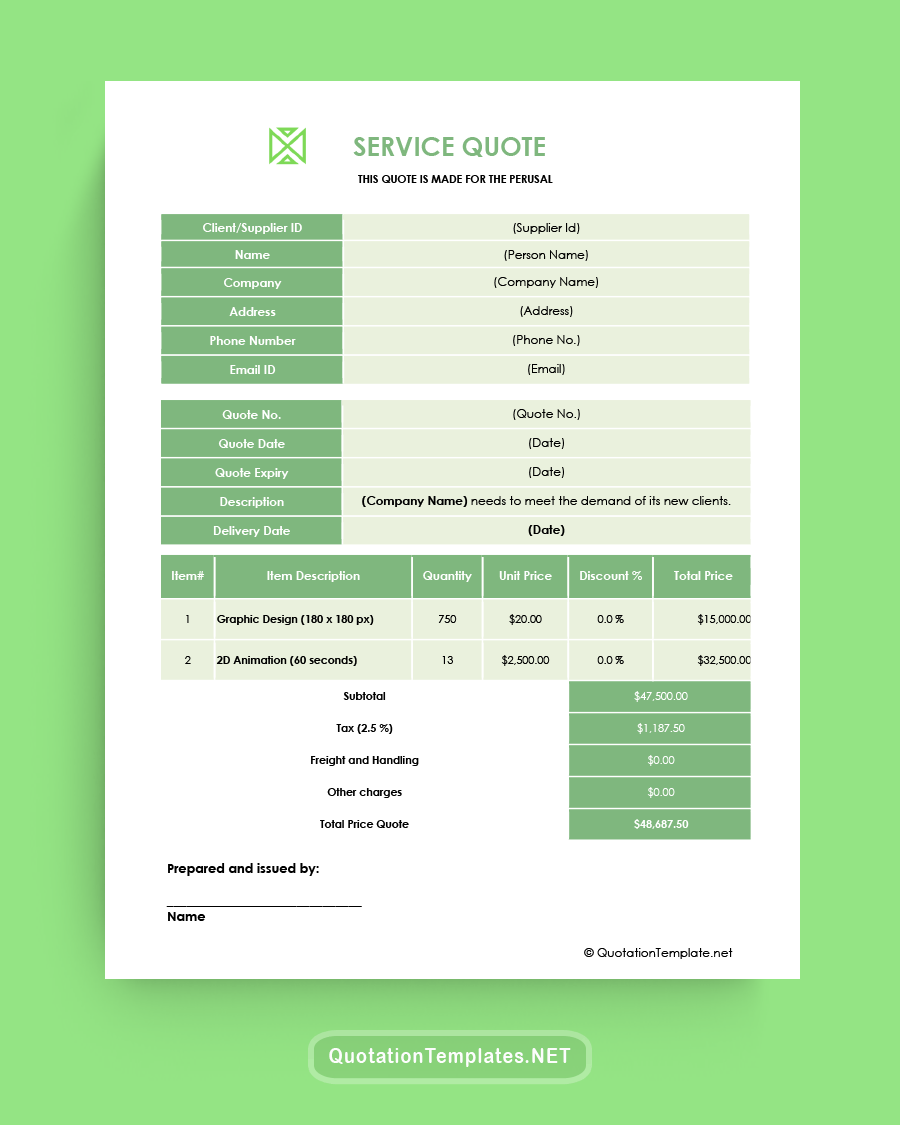

Essential Elements of a Loan Quote Template

The template should include the following elements:

- Lender and Borrower Information: Details about the lending institution and the potential borrower.

- Loan Amount: The principal amount that the borrower intends to take.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Schedule: Details about repayment frequency and duration.

- Fees and Charges: Any additional costs associated with the loan, like processing fees, late payment penalties, etc.

- Terms and Conditions: Any specific conditions associated with the loan.

How to Create a Loan Quote Template

Creating a Loan Quote Template involves a few simple steps:

- Identify Your Needs: Understand the information you need from the borrower and what you need to provide.

- Choose a Format: Decide on a layout that's clear and easy to understand. This could be a table, list, or a combination of both.

- Fill in Your Details: Add your financial institution's information and loan terms.

- Leave Space for Borrower Information: Ensure there's room for the borrower to fill in the necessary details.

- Review and Refine: Go through the template, making sure it's clear, concise, and comprehensive.

Tips for Using a Printable Loan Quote Template

- Customization: Customize the template to fit your specific needs and industry regulations.

- Consistency: Maintain the same format for all your loan quotes to make comparison easier for the borrower.

- Proofread: Always review and proofread the document before sending it to avoid any misunderstandings or miscommunication.

Frequently Asked Questions (FAQs)

Can a Loan Quote Template be used for different types of loans?

Yes, the template is typically designed to accommodate various types of loans. However, it may need slight modifications based on the specific loan type.

Should the template include information about penalties?

Yes, it's important to provide clear information about any potential penalties to ensure transparency.

The Role of Technology in Loan Quote Templates

With the rise of fintech, loan quote generation has become faster and more efficient. Automated quote generating systems can streamline the process, allowing lenders to produce and track loan quote templates with ease.

Conclusion

A Loan Quote Template is a powerful tool in the world of finance. It not only brings transparency and efficiency to the loan process but also enhances the professionalism of your institution. By understanding and implementing the insights provided in this article, you can confidently create and use a Loan Quote Template, fostering smoother loan transactions and informed decision-making.